In the dynamic landscape of modern finance, algorithmic trading has emerged as a transformative force. Utilizing sophisticated mathematical models and powerful computational algorithms, traders can implement trades at lightning-speeds, exploiting fleeting market opportunities with remarkable precision. This article delves into the realm of algorithmic trading mastery, exploring the key concepts, strategies, and tools necessary to achieve success in this highly competitive domain.

- Mastering the fundamentals of programming and data analysis is crucial for aspiring algorithmic traders.

- Creating robust trading algorithms requires a deep understanding of financial markets and statistical concepts.

- Simulating trading strategies rigorously is essential to reduce risk and optimize performance.

From technical analysis to risk management techniques, algorithmic trading encompasses a wide range of disciplines. Dedicated traders continuously refine their strategies and adapt to the ever-changing market dynamics. By means of continuous learning and practice, individuals can unlock the potential of algorithmic trading and survive in the complexities of the financial world.

Achieve Your Trading Potential with RankMyTrade

RankMyTrade offers a revolutionary platform that empowers investors to make strategic decisions. By leveraging the power of algorithms, RankMyTrade provides valuable insights into market trends, helping you discover profitable opportunities and reduce potential risks.

Utilizing its intuitive interface, RankMyTrade makes it easy for traders of all levels utilize cutting-edge data and analysis tools. Whether you are a seasoned professional, RankMyTrade provides the support you need to thrive in the dynamic world of trading.

Join the RankMyTrade revolution today and unlock your full trading potential.

Leveraging Strategies for Unprecedented Returns with RankMyTrade

Unlock the potential of automated trading with RankMyTrade's cutting-edge systems. By implementing sophisticated rules, our platform evaluates market data in real time, identifying lucrative trends that escape human traders. With RankMyTrade's intuitive interface, you can fine-tune your automated approach to align with your risk tolerance. Maximize your profits and achieve consistent growth by embracing the power of automation.

Deconstructing Algorithmic Trading: A RankMyTrade Perspective

Algorithmic trading has become the financial markets, with sophisticated algorithms executing trades at lightning speed. This dynamic landscape presents both opportunities and challenges for traders. RankMyTrade offers a unique perspective on deconstructing algorithmic trading, empowering traders to interpret the complexities of this ever-changing world. Through its platform, RankMyTrade supports traders to evaluate their approaches against historical data, pinpoint potential pitfalls, and fine-tune their algorithms for improved performance.

RankMyTrade's comprehensive data offer valuable insights into the patterns of algorithmic trading, helping traders to formulate strategic decisions. Furthermore, RankMyTrade's forum provides a invaluable platform for collaboration, where traders can connect with each other and learn from the experiences of others.

Unleashing Automation's Potential : RankMyTrade's Insights on Algorithmic Execution

In the rapidly evolving landscape of financial markets, automated systems have emerged as powerful tools for executing trades with unprecedented speed and precision. RankMyTrade, a leading platform in the field of algorithmic trading, provides invaluable insights into the strengths of this technology. By leveraging complex algorithms, traders can streamline their execution strategies, limiting risks and maximizing returns.

RankMyTrade's platform empowers traders with a range of capabilities algo trading designed to facilitate algorithmic execution. These include real-time data feeds, historical analysis platforms, and robust risk management systems. Through these features, traders can develop, test, and deploy customized algorithms that align with their individual strategies.

- Moreover, RankMyTrade's platform offers a accessible interface, making it suitable for both seasoned professionals and novice traders seeking to explore the world of algorithmic execution.

- Regularly updated research reports and educational resources provide valuable insights into the latest trends and best practices in algorithmic trading.

By embracing automation, traders can unlock a competitive edge in today's dynamic markets. RankMyTrade's expertise and innovative platform provide the necessary tools to navigate the complexities of algorithmic execution and excel in the ever-evolving financial landscape.

Supercharge Your Trades: RankMyTrade's Algorithm-Driven Analysis and Sorting

In the dynamic world of trading, making well-informed decisions can be crucial. RankMyTrade emerges as a powerful tool, leveraging advanced algorithms to assess your trades and provide actionable rankings. Its sophisticated system examines vast amounts of market data, identifying patterns and trends that retail investors might miss. This data-driven approach empowers you to improve your trading strategy by pinpointing the most profitable opportunities.

- RankMyTrade's algorithm weighs a multitude of factors, including market indicators, to provide a comprehensive assessment of your trades.

- Investors can leverage these insights to identify which trades are more inclined to be successful

- Through its dynamic nature, the system adjusts to changing market conditions, ensuring that your strategies remain current

In essence, RankMyTrade's algorithmic analysis and ranking system delivers a distinct advantage for traders of all levels, helping them optimize their trading performance.

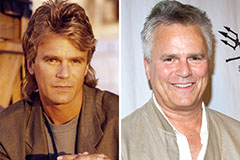

Charlie Korsmo Then & Now!

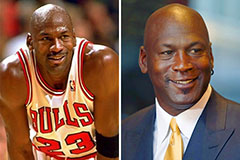

Charlie Korsmo Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Danica McKellar Then & Now!

Danica McKellar Then & Now! Talia Balsam Then & Now!

Talia Balsam Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!